Category: public blockchains

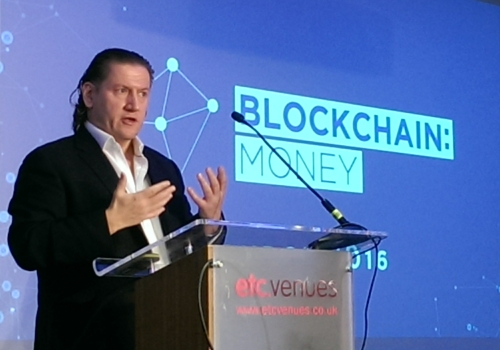

Capital Markets Veteran Gavin Smith Calls for Better Security Standards for Bitcoin Traders

“Blockchain fintech companies can not only provide better security for bitcoin traders we can also solve the problems that plague conventional capital market companies.”

November 15, 2016 London

This is the opinion voiced at the Blockchain Money Conference in London last week. Speaking to an audience of investors, entrepreneurs, and experts including Jon Matonis, Michael Parsons and Roger Ver, First Global Credit’s CEO Smith proposed that companies needed to take a more pragmatic view of risk. During his talk he highlighted specific areas of risk that were being overlooked by bitcoin companies.

“In the conventional capital markets we have many metrics used to measure risk. They are not great; they are not foolproof, but they are a decent framework that [start to] measure where the risk comes from. In the cryptocurrency world, we don’t yet have that.” — Smith asserted.

His statement came in response to ongoing security threats that challenge bitcoin exchanges. There is not a single year that has gone without reports of online bitcoin wallets being hacked. Many speculators turn to bitcoin trading in hopes of making easy profits from its trademark price volatility. Exchanges such as BitFinex further attract traders by offering leveraged trading based on loans being made by bitcoin holders who are not skilled traders but still want to make a return on their crypto-assets.

Are these practices — and whatever returns they promise — worth the risk if the exchange cannot provide investors with insurance during a security breach? Even the most respected Bitcoin exchanges are not able to protect their customers from hacks that have led to over $80 million worth of losses in last two years.

“BitFinex was one of the largest and most respected Bitcoin exchanges and they still got hacked,” Smith stated. “It clearly illustrates how vulnerable our funds are in absence of adequate risk management protocols.”

Minimising Risks

Exemplifying his own company that allows bitcoins to be used as collateral margin to trade against fiat currencies, world-wide stock markets, precious metals and ETFs, Smith described what his company does to effectively reduce risk especially counterparty risk.

“First we actively grade bitcoin exchanges based on a weighted set of criteria including whether the exchange is domiciled in a respected jurisdiction, the transparency of their management structure and finally the longevity of the exchange. Once we have identified acceptable counterparties we spread assets across multiple exchanges. We need to be in a situation where we keep operating and continue to provide our customers with service even if one of our counterparties fail. So we don’t risk more than 15% of reserves on any one bitcoin exchange.”

“We further control risk by minimising the time that we have funds out of our control. We do this by continuously moving funds out of exchanges when not actively being used to trade.”

Exchanges are Centralising Bitcoin

“One of the benefits of bitcoin is that it should cut away middlemen from financial settlements, but bitcoin exchanges have failed to follow the vision themselves by acting like centralised authorities.” Smith highlighted these points and didn’t shy away from identifying that his own company was subject to the same issues. He then pointed to current and upcoming developments that are steps in the right direction of combating counterparty risk.

“I believe the real challenge over the next 2 years – for companies who operate in the cryptocurrency capital markets – is to move beyond this model of us holding client funds and being ourselves, a point of risk for the customer assets.”

“We’ve already seen some attempts to deal with this problem, but thus far these have failed because they do not cover the security of funds over the full trade lifecycle. They protect funds when they are initially placed on the exchange, but as soon as funds are committed to an active trade they are subject to the same risks as they are on a conventional bitcoin exchange because they are pooled with other trades. So while protecting inactive funds provides a partial solution, this benefit is counteracted as soon as you open a position and start trading. This is not a particularly useful innovation for funds lodged with First Global because we are actively moving dormant money out of the control of the exchange anyway. So a solution that only protects funds when there is no active trade does not really add value.”

“The second area is using smart contracts to replicate trading. Again, this is a move in the right direction but the problem with the practical use of smart contracts at the moment is lack of liquidity. There is a real challenge of creating a solution that provides good liquidity and real security through the full lifecycle of a trade including point of settlement. To my mind that is where the real benefit and the future lies; If we can create a solution that achieves this we have not only provided value in the cryptocurrency capital markets, we’ve created something that actually leapfrogs existing mainstream capital market risk.”

“All counterparty risk management strategies in existing capital markets are based on allowing banks to transact business securely. Allow bank A to trade with bank B in a way that keeps them from having counterparty risk. Nobody considers the last step in the cycle, the piece that covers the transfer of funds to the end customer. That customer is still expected to assume all the counterparty risk of working with a bank or broker or other institution. If we can create an environment that allows customer A to trade with customer B without any added counterparty risk from working with an institution in the middle, that’s where I think the public blockchain can add real value to the whole finance industry and our market will pull ahead of conventional markets in what we can offer our customers. So in the next two years not only will counterparty risk become actively managed in the cryptocurrency space, I can imagine ways blockchain tech can be adapted for mainstream markets counterparty risk management as well.”

Private Blockchains are good enough. Really?

by Marcie D Terman

by Marcie D Terman

16 February 2016

Geneva/London/Hong Kong

Cross border payment processor Earthport is the latest established company to throw its weight behind the adoption of blockchain technology for banks and other orthodox financial service providers. The company is driving this with the message, “you do not have to endure the risk of working with a start-up to benefit from blockchain tech.” Earthport, a mature company, is adding a range of blockchain based services to the existing menu of what they offer their banking and corporate customers.

Over the last six months the campaign to highlight the advantages of blockchain and private networks backed by banks and governments over bitcoin is having a greater degree of success. Internal dissension among the core developer group coupled with continuous light pressure from bodies like the European Parliament and successful PR campaigns like the R3 banking consortium all work towards slowing the adoption of public blockchains and its leading example bitcoin. The latest effort to move the public’s attention away from bitcoin is evidenced by the recent renaming of blockchain tech as DLT, Distributed Ledger Technology.

The accountability and economies that internally managed blockchains will impose on financial institutions is certainly a positive step. For example, if mortgages had been maintained on private blockchains prior to 2000, the issues at the core of the Credit Default swap Crises of 2008 would probably not have been possible. This is because it would have been impossible to hide the credit worthiness and payment history of high risk mortgages which caused the mis-pricing of Mortgage Backed Securities sold to financial institutions worldwide.

But does the value to be derived from private blockchains make it acceptable to ignore the value of public blockchains like bitcoins? That is certainly what banks and governments hope will be accepted by the public at large. To drive home the message that bitcoins are dangerous we are continually reminded that woven into their history are tales of the Silk Road, Mt. GoX and the loss of significant wealth through misplaced private keys and hard drives. All new technology at its beginnings are difficult to use, unfamiliar and therefore unpopular with the mainstream. If pressed, it’s not hard to remember that 20 years ago there was no Amazon or Google and many thought the internet was the primary communications tool of pornographers and felons. And anyone old enough will remember the arcana you needed to master to set-up Internet software and modems?

There will be mistakes. But true innovation comes from young companies. Though it is to be noted that on many occasions young companies are piloted by seasoned professionals discontent with the status quo. It can reasonably argued that there is considerably more risk limiting the custodianship of blockchain tech to established companies, with behaviour that in many cases is not the most trustworthy or laudable. However much energy is applied towards slowing the adoption of bitcoins and other public blockchains, and it cannot be stated with certainty that we know what form digital currency will take, Pandora’s box is well and truly open, the paradigm shift is in progress and the ultimate result will be accountability in all of blockchan’s uses.

What do you think?